INDIA: While the New York-based investment research firm Hindenburg’s report caused a stir in India, with Adani Group’s shares plummeting, the group responded with a 413-page rebuttal on Sunday, calling the report malicious and baseless.

The Adani Group claimed that “the document is a malicious combination of selective misinformation and concealed facts relating to baseless allegations to drive an ulterior motive. This is rife with conflict of interest and intended only to create a false market in securities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors”.

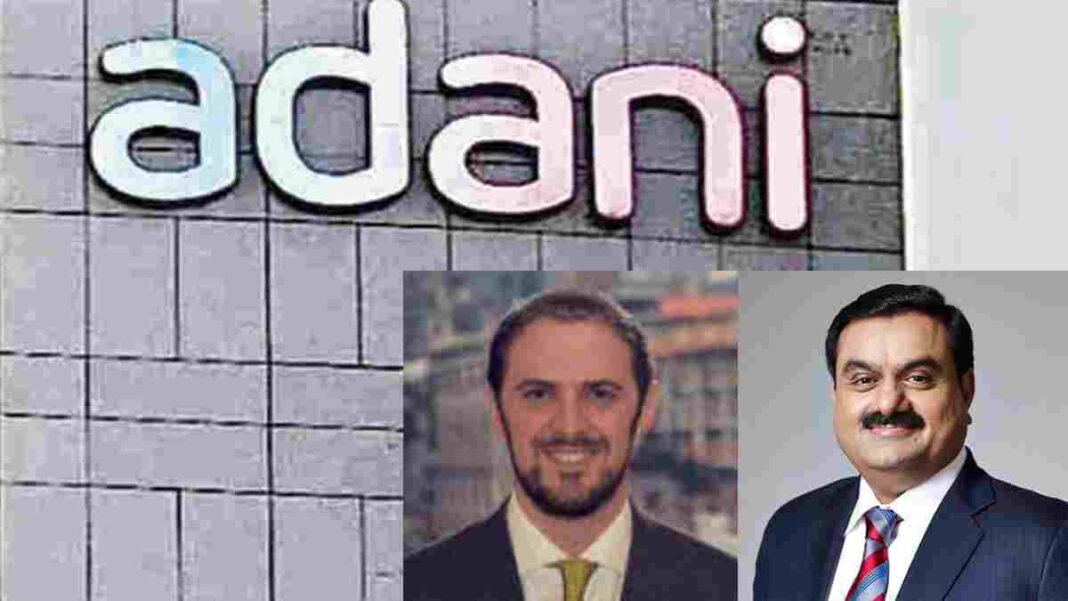

Hindenburg Research LLC, an investment research firm founded by Nathan Anderson, focuses on activist short-selling.

In its report on January 24, Hindenburg stated, “We reveal the findings of our 2-year investigation, presenting evidence that the $218 billion Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over decades.”

Gautam Adani, Founder and Chairman of the Adani Group, has a net worth of about $120 billion, gaining over $100 billion in the past three years mostly due to stock price growth in the group’s seven key listed firms, which have risen an average of 819 per cent.

“Even if you ignore the results of our investigation and take Adani Group’s financials at face value, its seven key listed companies have a fundamental downside of 85% due to sky-high valuations,” the report said, raising concerns about debt levels and the alleged use of tax havens.

The Adani Group has come out with a Rs 20,000 crore follow-on public offer (FPO), and as a sequel to the report, seven listed companies of the conglomerate have lost a combined $48 billion in market value.

Adani stated that out of 89 questions raised by Hindenburg, some of these questions are regarding the group’s related party transactions, the Directorate of Revenue Intelligence, and court cases.

Also, 21 questions have been made public since 2015, so it can’t be said that they are the result of a 2-year investigation or something similar.

Adani said the short seller “falsely claimed” that “Emerging Market Investment DMCC” gave a loan of USD 1 billion to “Mahan Energen”.

In fact, “Emerging Market” bought USD 1 billion of “unsustainable debt” from “Mahan Energen’s” lenders for USD 100 as part of a resolution plan approved by the National Company Law Tribunal under the Indian Bankruptcy Code.

Adani Green Energy

Hindenburg has raised questions about Adani Green Energy Limited’s offer for sale in 2019. Still, he is ignoring that in India, OFS is a regulated process carried out through an automated order book matching process on the stock exchange platform, Adani said.

Gautam Adani’s brother

Hindenburg said that Gautam Adani’s older brother Vinod Adani runs a huge network of offshore shell companies in Mauritius, Cyprus, the UAE, Singapore, and several Caribbean islands with the help of a few close friends.

The Vinod Adani-associated entities have no employees, independent addresses, or phone numbers. Despite this, they have collectively moved billions of dollars into Adani’s publicly listed and private entities.

Also, 13 websites for companies with ties to Vinod Adani were made on the same days. These websites only had stock photos and didn’t name any of the employees. They all listed the same set of services, such as “consumption abroad” and “commercial presence.”

In response, the Adani group said Vinod Adani does not hold any managerial position in any Adani-listed entities or their subsidiaries and has no role in their day-to-day affairs.

Questions on third-party entities

Adani said that shares of companies that are listed on Indian stock exchanges are often bought and sold and that a listed company is not required to have information about its public shareholders and investors.

In the meantime, Adani Group has threatened to file a defamation suit. In contrast, Hindenburg has said it will demand documents in the legal discovery process if Adani Group files a lawsuit in the United States.

Also Read: Hindenburg Research Accuses Adani Group of Pulling “The Largest Con in Corporate History”