UNITED STATES: Nvidia’s CEO, Jensen Huang, has expressed unwavering confidence in the enduring potential of the artificial intelligence (AI) surge, projecting its impact well into the next year. This assertion was supported by what is being dubbed one of the most substantial single bets ever witnessed in the tech sector.

The company’s robust sales forecast, unveiled on Wednesday, exceeded Wall Street’s predictions and catalyzed plans for a massive $25 billion share repurchase. This strategic move is often employed by businesses to signal that their leadership believes the company is undervalued.

The market has responded in kind, propelling Nvidia’s stock price to soar over threefold in the current year alone, setting the stage for an imminent all-time high following the announcement.

The announcement also quenched uncertainties expressed by some analysts regarding the longevity of the ongoing AI craze. Nvidia disclosed intentions to ramp up hardware production well into the upcoming year, reinforcing the company’s commitment to capitalize on the persisting AI trend.

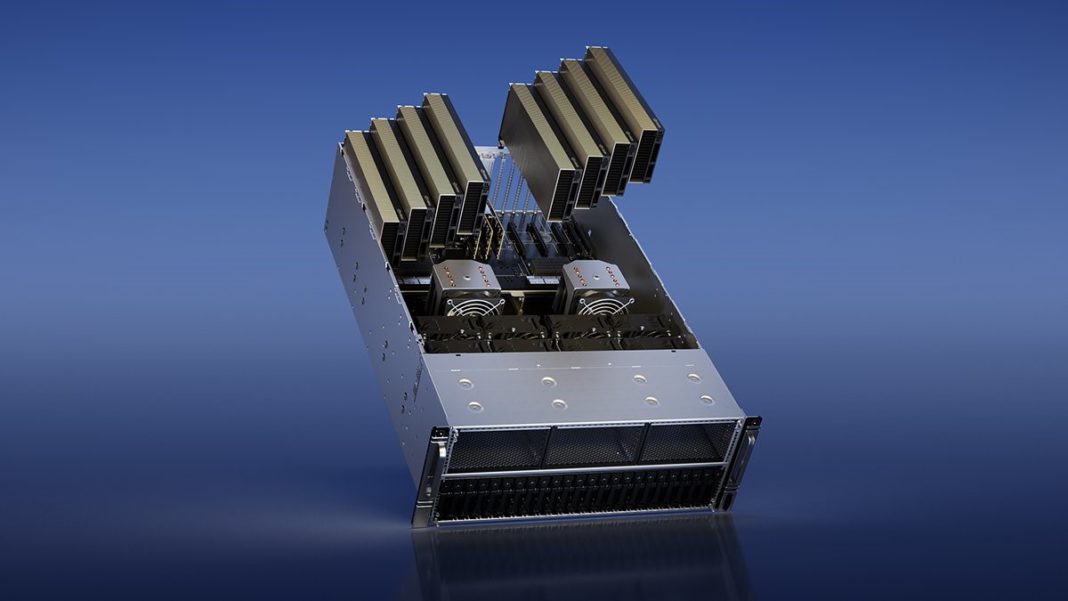

Nvidia holds a virtual monopoly in the realm of computing systems that power groundbreaking AI applications, including OpenAI’s ChatGPT. During an investor conference call, Huang stated, “We have excellent visibility through the year and into next year, and we’re already planning the next-generation infrastructure with leading cloud computing firms and data center builders.”

This visibility is attributed to two primary drivers: the shift from conventional data centers built around central processors to Nvidia’s potent chips and the escalating adoption of AI-generated content across various sectors.

Huang’s audacious move to repurchase stock despite record-high prices has placed Nvidia at the forefront of AI-focused investments, surpassing even other tech giants in their commitment to the AI landscape.

However, this decision comes as Nvidia’s price-to-earnings ratio experienced a decline from 60 to approximately 43 following analyst upgrades in May.

Major players like Microsoft, Meta Platforms, and Amazon’s AWS have collectively channeled billions into AI-related hardware and products, reflecting the industry’s collective anticipation of burgeoning demand.

Nvidia’s impressive financial performance underscores the insatiable demand for its chips, as evidenced by the company’s adjusted gross margins almost doubling to 71.2% in the last quarter, a rare feat in the semiconductor sector.

While analysts diverge on the potential duration of this AI surge, Nvidia’s resolute stance underscores its commitment to continued innovation and market leadership. As Huang concluded, “This fundamental shift is not going to end. This is not a one-quarter thing.”

Also Read: HP OMEN 17 Unleashes Gaming Power with Intel Core i9, NVIDIA RTX 4080